Gold IRAs present an attractive indicates of diversifying a retirement portfolio for traders who dread inventory industry fluctuations. But To maximise Advantages even though preventing prospective traps, it's essential that a person be totally informed of all possible tax implications affiliated with gold IRA investments before making decisions.

Gold ETNs (Trade-Traded Notes): Gold ETNs are credit card debt instruments designed to keep track of the cost of gold without representing precise possession; like ETFs, these notes commonly attribute maturity dates and so are backed by issuer’s creditworthiness – As a result being suited inclusions into an IRA for gold buyers; however, traders ought to continue being conscious of any associated credit rating hazard threats with these issuances.

Be Educated We have spent two hundred+ hours exploring and examining the gold dealer business to give you our best selections.

A gold IRA is a form of unique retirement account that may be funded with physical gold and other precious metals in the form of bullion, coins, or bars. As you may perhaps know, gold is fairly important so you will need to be sure that you choose the proper gold IRA company.

Rate Composition: Search for transparency. Some companies lure you in with small service fees only to hit you with concealed fees down the line.

For our rankings, we sent a digital survey, consisting of over twenty queries, to each firm that we reviewed. Our scientists verified the my blog study information and confirmed any lacking details points by getting in contact with Every organization specifically and via on the net study.

Savings Investment: Shoppers could also fund their gold IRA account which has a transfer from a savings account, income, or other types of liquid savings.

When selecting the best rated gold IRA business to your investment requirements, it is important to take into consideration various vital elements:

One more reason gold coins are so common, amongst buyers, is that there is image source rarely a lack of output considering the fact that most gold bullion coins are minted yearly and according to desire.

American Hartford Gold has actually been assisting traders liquidate their gold and silver for a few years. They might get your precious metals again Anytime – and on quick observe – without having charging you any costs.

Economic Steadiness: Gold often performs effectively for the duration of financial downturns, providing a safe haven to your assets.

A number of other considerably less prevalent differed tax retirement accounts may very well be qualified and a good gold IRA corporation will assist you to to verify the eligibility of your recent retirement account, need to you need to accomplish a rollover.

Everyday Income Tax: Classic gold IRA distributions are topic to common earnings tax rather then money gains taxes, a crucial difference if your gold has substantially appreciated during its time held by you.

Can I Physically Consider Possession in the Gold in My IRA Account? Some gold IRA companies will assist you to view your precious metals inside their accredited depository. As your precious metals are owned by your IRA, You can not liquidate your assets right up until the age of fifty nine ½. When you get to 59 ½, you could commonly obtain your assets in the shape of the hard cash payment or physical precious metals.

Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Andrea Barber Then & Now!

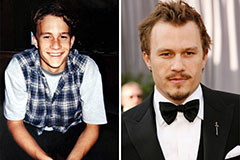

Andrea Barber Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!